Emerging Markets: Turning the page?

MICHAEL REYNAL 08-May-2023

The challenges facing emerging markets (EM) investors have been well documented. Inflation has been elevated and sticky, and it has drawn sharp monetary policy responses around the world. Rising interest rates have increased the cost of money, and for global central banks, the tradeoff of global growth for lower inflation seems clear. A strong U.S. dollar (USD) has put pressure on smaller, regional currencies. And when you add in a generous dose of geopolitical tension with the lingering effects of zero-covid policies in China, the outcomes are quite limited, leaving little to the imagination as to why EM equities have struggled in recent years.

Fortunately, a new chapter has begun taking shape in the broader EM landscape. The first quarter of 2023 has offered signals that the backdrop for EM equities is improving. In fact, our team sees several catalysts that suggest a period of outperformance (versus developed market equities) may be ahead for emerging markets.

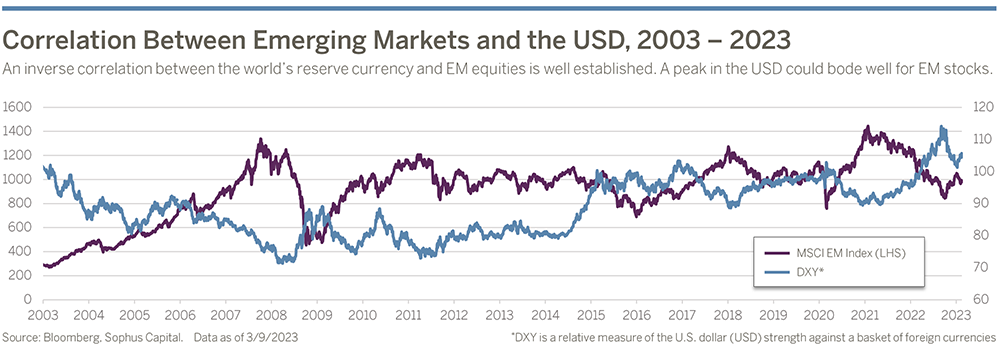

In our view, there are several ingredients essential to EM outperformance in 2023 and beyond. Central among these is a peak in the U.S. dollar, which began taking shape effectively over the course of the fourth quarter, before reversing somewhat to start the new year. For context, the inverse correlation between the world’s reserve currency and EM equities is well established (see chart below).

Consequently, the strong USD has been challenging for EM given the weaker purchasing power and lower creditworthiness it causes for countries with dollar-denominated debt. It also adds to the inflationary pressures given that raw materials and commodities are typically priced in USD. However, many EM central banks started monetary tightening before the Fed, and in some instances (like in Brazil) we believe that these countries have largely completed their tightening cycles. And of course, the correlation goes both ways: a weak dollar has historically led to EM outperformance.

Another reason for optimism comes from China, which is the largest constituent of the MSCI Emerging Markets Index accounting for over 30% of the benchmark. It’s true that China was one of the worst performing markets in the index in 2022 thanks in no small part to the many well-known risks to the investment case–regulation, real estate defaults, and the zero-Covid policy, among others. Indeed, these factors weighed heavily on investor sentiment and, by extension, foreign investor flows.

But in late 2022, China dynamically changed course, announcing its Covid policy recalibration and housing market stabilization measures all in the span of a few days. For the first time since 2019, domestic macro policies and Covid management are aligning to support a growth recovery, rather than exerting opposing forces. Looking beyond the initial reopening rebound, which has been driven by pent up demand from Chinese consumers emerging from their Covid-slumber ready to spend, we anticipate consumption will lie at the heart of China’s growth story. This, in turn, should drive earnings upgrades for many Chinese equities.

Geopolitical issues dominated world news in 2022, with Russia’s war in Ukraine and competition between the U.S. and China impacting everything from energy to food to semiconductors. Supply chains are only just stabilizing following dislocations in trade routes experienced during the pandemic, despite tensions on both sides. While the nearshoring of supply chains is one theme which has gained considerable traction into 2023, peaking food prices present perhaps a more tangible, positive catalyst near-term because food has triple the weight in CPI (inflation) in EM than in their DM counterparts. The war in Ukraine has spurred a global food crisis that has sent prices for grains, cooking oils, fuel, and fertilizer soaring. As such, geopolitics proved a major driver of food prices, especially given strong linkages between energy and food. Any softening in food prices, or even a diplomatic resolution to the war in Ukraine, could help fuel EM markets.

Despite the challenging backdrop for emerging market equities, our team sees reasons for optimism. Although headwinds and risks will always exist among this cohort of developing economies, we see market conditions stabilizing already in 2023, signaling the potential conclusion of this most recent difficult chapter. In fact, several of the catalysts have begun to play out. Our team stands eager to see emerging markets turn the page and begin the next chapter of economic development.