Fixed Income: Money in motion

Allyson Krautheim 10-Oct-2024

The Federal Reserve has finally made its long-awaited move to lower interest rates. And based on Fed Chairman Jerome Powell’s recent comments, fed funds futures are now pricing in several more rate cuts this year and next. This might be a signal that the days of comfortably parking cash in money market fund funds—many of which were still yielding above 5% during September, according to Crane Data—are numbered.

We can hardly fault investors for having been a little complacent by taking advantage of attractive ultra-short yields in money market funds, especially given how the Fed had been sticking to its “higher-for-longer” messaging for so long. But recent tame inflation data, as well as moderating tight labor conditions, finally gave the green light to a new monetary easing cycle. How many more rate cuts is anybody’s guess, but one thing seems likely: Yields in money market funds, which are based on ultra-short-term interest rates, are likely to fall in virtual lockstep with the federal funds rate.

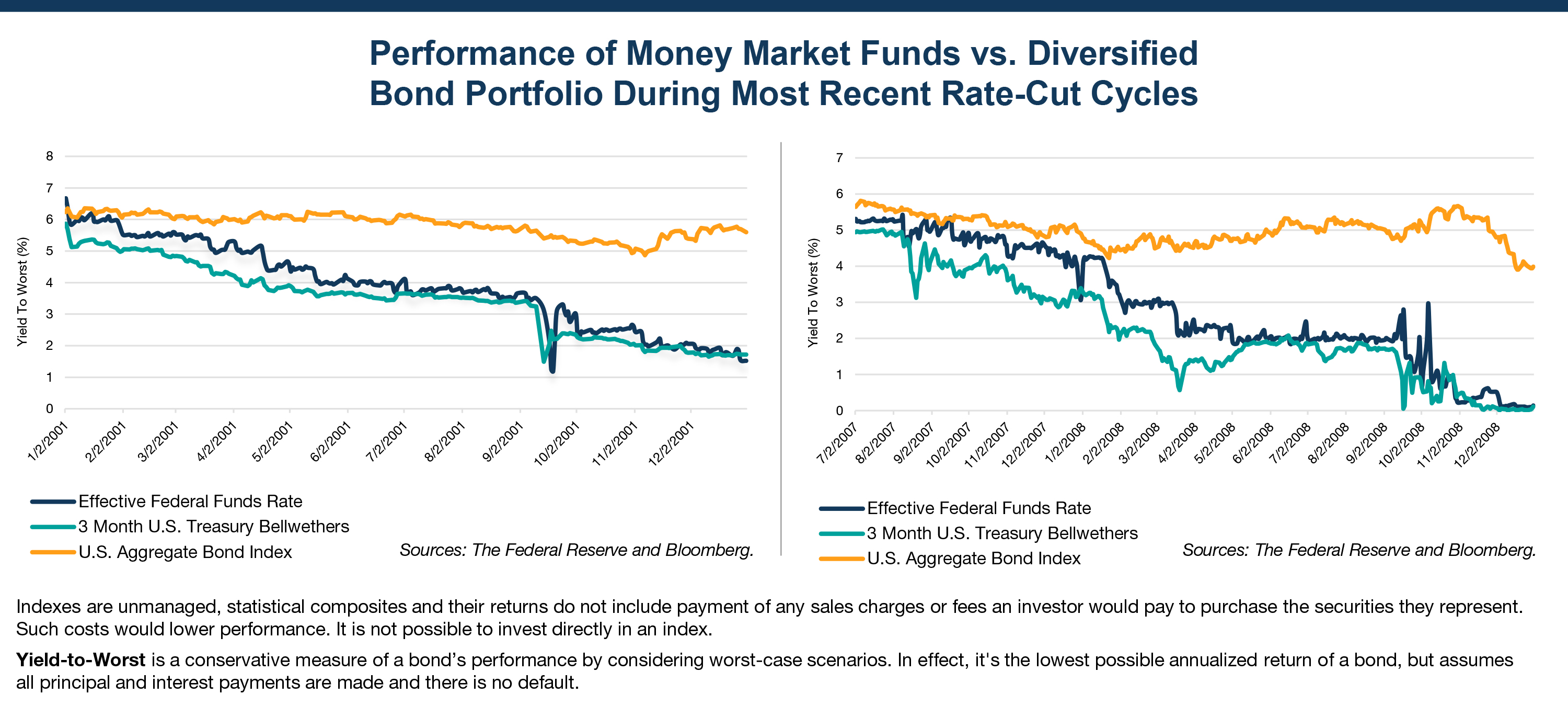

What informs our opinion? A quick look at prior rate-cut cycles is a good place to start.

As illustrated in the two charts above, the shorter-term yields (i.e. money market yields) fell significantly over the two previous rate cutting cycles, while broader (and longer duration) fixed income yields—as measured by the U.S. Aggregate Bond Index as a proxy for a diversified investment-grade bond portfolio—declined by much less over the same periods.

Certainly, we don’t deny that yields across the curve also are likely to move lower during any easing cycle. They already have. The 10-year Treasury yield, for example, dipped this summer from above 4.25% in July and was bouncing around 3.70% in mid-September. But the current situation might motivate investors to consider putting money in motion and allocating a bit further out on the yield curve.

The Current Environment

Assuming investors agree that it’s time to get off the sidelines, here are few thoughts on allocating to fixed income at this juncture:

- Fixed income vs. equities. We looked at two valuation metrics to comparing Treasury bonds and investment-grade bonds to the S&P 500®. For starters, the yield on the 10-year U.S. Treasury currently exceeds the dividend yield on the S&P 500. And going one step further, the yield on investment-grade U.S. corporate bonds, as represented by the Bloomberg U.S. Aggregate, has surpassed the earnings yield on the S&P 500. On both accounts, this suggests bonds are comparatively cheap. This might be a comfort for any investor currently worried about a possible recession or allocating new money to stocks after they’ve been on a strong run.

- Starting yields remain attractive. Rates may be trending lower, but in our view investors have an opportunity to benefit from still-attractive starting yields. Our experience suggests that fixed income returns are highly correlated to starting yields over a longer time horizon. Moreover, buying bonds (or bond funds) primarily for income and as a counterbalance to offset equity risk should be among the top reasons for investing in fixed income in the first place. We see no reason to doubt the traditional role bonds can play in a diversified investment portfolio today.

- Consider active management: We continue to believe that an actively managed approach to fixed income can not only manage risk, but also tilt portfolios to more attractive segments of the broader fixed income market. We acknowledge that the Fed may be cutting interest rates to stimulate the economy. Thus, the slightly elevated recession risks and tighter-than-historical average credit spreads support more defensive credit positioning, in our opinion. However, we also see pockets of potential opportunity to capture attractive risk-adjusted yields. Specifically, we think the environment for Asset Backed Securities (ABS) and Agency Mortgage-Backed Securities (MBS) looks compelling.

Moreover, as we progress into the late 2024, we believe that corporate earnings will weaken, spreads will widen, especially in the lower-rated, high yield and leveraged loan issuers, and the default rate may continue to gradually rise. All this matters when it comes to managing risk, and it underscores why we prefer an actively managed approach based on deep fundamental credit analysis versus simply buying a passive bond fund.

Not too late

It looks like we are embarking on a new era as the Fed pivots again to a more accommodative monetary stance. This could be the catalyst for many investors to get off the sidelines. Yes, rates have already moved off their peak. But we believe it’s not too late for investors to meet with advisors to discuss the pros and cons of allocating new money to fixed income and possibly adding duration to lock in yield. Given the current situation, investors really should be asking: How much longer will I be able to park cash in money market funds and collect elevated yields above 5%?