Lower oil prices necessitate capex cuts, productivity gains

STEPHANIE GARZA, ASA PHILLIP PENNELL, CFA 11-Oct-2019

We recently met with senior managements of a wide range of companies in the energy industry, and came away with a consistent theme: Lower prices for oil, natural gas and natural gas liquids are spurring spending cuts for exploration and production (E&P) as companies continue in their efforts to meet investor expectations for free cash flow generation.

Lower spending by E&P companies on drilling and well completion stands to have a downstream impact on other segments of the energy sector. Oil field service companies, for instance, will likely see reduced demand for their work, and pipeline operators can be expected to lower their capital expenditures in anticipation of flat to declining future production.

As a result of budget cuts, E&P companies are “high grading” their capital spending – focusing on projects expected to earn the highest near-term returns, or on quick wins, such as bolt-on acquisitions.

Other anticipated moves include a redoubled effort to generate free cash flow (cash flow from operations less capital spending and dividends) and acreage swaps between companies to concentrate their infrastructure footprint and allow for larger unconventional well designs. Further industry consolidation is a likely response.

Companies are also trying to extract greater efficiencies from existing infrastructure. This includes drilling new wells faster, using existing offshore facilities to reduce production costs, and a broad initiative to introduce automation to decrease labor costs and enable more centralized control over often far-flung operations.

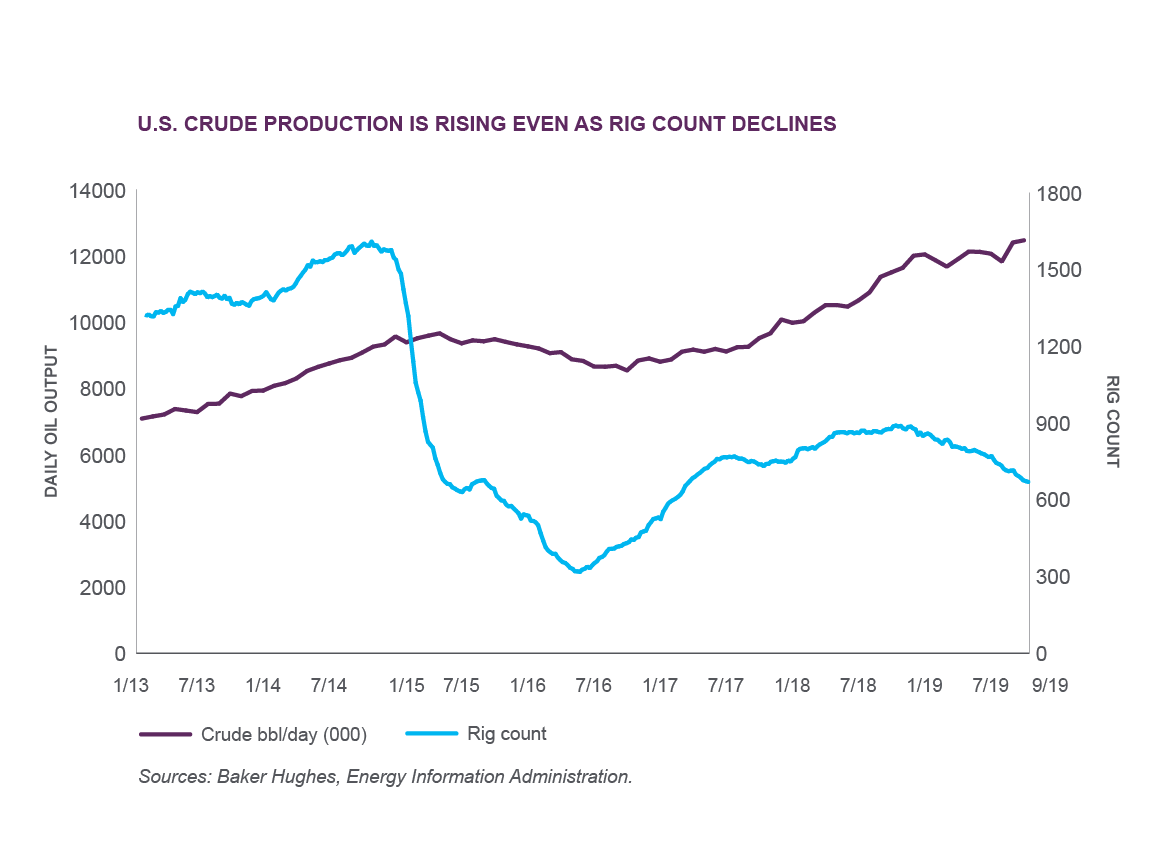

Many of these moves appear to be showing up in higher productivity in the U.S. The weekly Baker Hughes oil rig count has fallen by nearly a quarter over the past year (887 to 668 at the end of November), while daily production has increased from 11.7 million barrels to an estimated 12.9 million barrels over the same period.

This has resulted in demand for increased technological services from oil field service companies, which also face a balancing act – they would not want to be too hasty in commercializing technologies that would reduce demand for their services in the longer run.

This has resulted in demand for increased technological services from oil field service companies, which also face a balancing act – they would not want to be too hasty in commercializing technologies that would reduce demand for their services in the longer run.

From an investment standpoint, this sort of operating environment makes for one in which credit selection is key. Companies with higher-quality acreage, more advanced technology, greater balance sheet flexibility and better management are positioned to do better.

Companies that lack these attributes can expect to face unsympathetic capital markets, fall prey to private equity firms prowling for cheap acquisitions, or file for bankruptcy. All of these potential outcomes carry negative consequences for bond holders.