Muni bond overview: Stepping off the roller coaster?

MARK CLAYTON, CFA ANDREW HATTMAN, CFA 12-Jan-2021

The roller coaster ride of 2020 is not what municipal bond investors had in mind at the beginning of the year. Typically, muni investors are looking for steady, tax-exempt income to help them maintain a lifestyle in retirement or to provide stability for their overall portfolio. While returns in the muni market have ended on a strong note in 2020, the ride was bumpy at times.

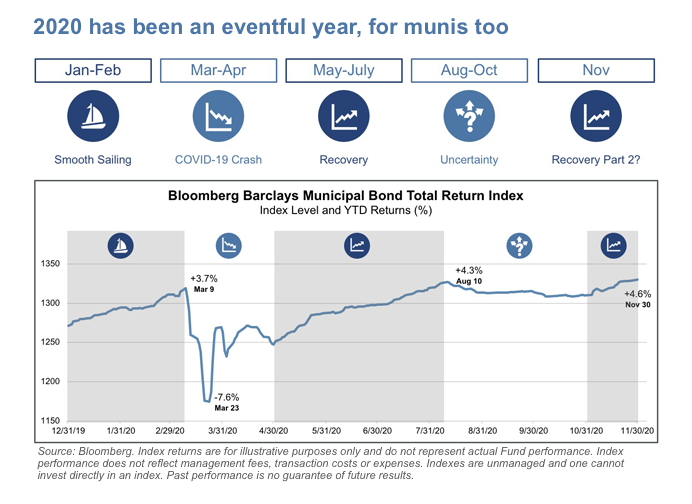

Before looking ahead to re-evaluate the potential role and appropriateness of municipal bonds, consider what transpired this past year. The first two months were smooth sailing, and the muni market saw plenty of demand and strong returns. On March 9, 2020, the Bloomberg Barclays Muni Bond Total Return Index was up 3.7% year-to-date, and mutual funds had been enjoying consistent inflows, according to ICI data.

In March, munis--and most other asset classes—reacted strongly to the emerging pandemic and ensuing economic shutdowns. Volatility soared, liquidity evaporated, and the muni market benchmark hit its low, down 7.6% year-to-date on March 23, 2020.

In March, munis--and most other asset classes—reacted strongly to the emerging pandemic and ensuing economic shutdowns. Volatility soared, liquidity evaporated, and the muni market benchmark hit its low, down 7.6% year-to-date on March 23, 2020.

The market rebounded relatively quickly, likely due to attractive yields and government intervention (both actual and potential). In the late Summer/early Fall, caution returned to the market as investors worried about the November elections, regional surges in COVID-19 cases, lack of additional stimulus for state and local governments, and a glut of new issuance from borrowers rushing to issue bonds ahead of the election. Post-election, the market appears to have started a new round of recovery, likely buoyed by election clarity (for the most part), promising news on vaccines, and a lack of new issuance. By the end of November, the market was up a respectable 4.6% for the year.

The kind of volatility experienced during 2020 is uncommon in the municipal market, and not surprisingly it shook some investors’ confidence. Thus, it might be helpful to reiterate a few facts about this historically stable section of the

fixed income universe.

Credit quality for municipal bonds has historically been stable over time. Issuers are typically resilient given the essential services they provide and an ability to adapt to changing external influences. The fact that the Federal Reserve’s rhetoric and actions provided support to the markets this year should only give investors greater confidence. Although expected to end at the year’s conclusion, the Municipal Liquidity Facility effectively served its desired role.

A recent credit default study by Moody’s dated July 15, 2020 supports the notion of sound credit strength. Since 1970, investment-grade issuers have experienced a 10-year average cumulative default rate of a miniscule 0.10%, while all-rated municipal securities had a default rate of just 0.16%. This Moody’s study confirms that the absolute number of municipal defaults remained low for rated issues.

Nevertheless, we acknowledge that the COVID-19 pandemic has introduced new stresses on many municipal bond issuers. Actions to mitigate the pandemic, including economic shutdowns, have taken a toll on credit quality, and there have been several recent high-profile ratings downgrades. Additionally, the rating agencies have assigned negative outlooks to numerous sectors.

But there’s plenty of encouraging news and signs that the historic volatility of 2020 may be a thing of the past. For starters, a massive wave of defaults within the municipal bond asset class is not foreseen at this time. Some additional downward pressure on ratings could materialize, especially if widespread economic shutdowns again occur, but some sectors are better positioned than others. For instance, state and local governments continue to provide essential services devoid of competition. Coupled with their ability to collect taxes and access capital markets to meet short-term cash flow disruptions, we expect little more than potential ratings downgrades.

Some select sectors, such as weaker-positioned hospitals and senior living facilities, may face short-term challenges, including the potential for covenant violations, but most issuers possess sufficient balance sheets and should weather the pandemic, in our opinion. In fact, the pandemic may be creating situations whereby the market misunderstands and misprices risk, thereby providing potential relative value opportunities. Longer-term, we anticipate healthcare sectors will eventually stabilize on the whole.

At this point, we believe the worst is behind us and we are getting closer to a return to normalcy. Widespread distribution of an effective COVID-19 vaccine seems likely by the end of 2021, and a resumption of normal social and economic activity should result. However, we are not there yet, and there could be a few more ups and downs as we continue to work towards a full recovery. As always, we encourage investors to take a long-term view.