Timing never pays

U-WEN KOK, CFA 25-Sep-2020

Calling market bottoms or picking tops makes for fun debate among friends, but as a centerpiece of a global investment strategy—not so much.

Often, when we are meeting with financial advisors and clients, we are asked if “now” is the opportune time to allocate to global stocks, or whether they should wait. Unfortunately, the standard answer we give—as mundane as it might be—is that we don’t know. Nobody does. How many pundits accurately handicapped the markets during the first quarter? And how many went on to predict the robust bounce in the second and third quarters?

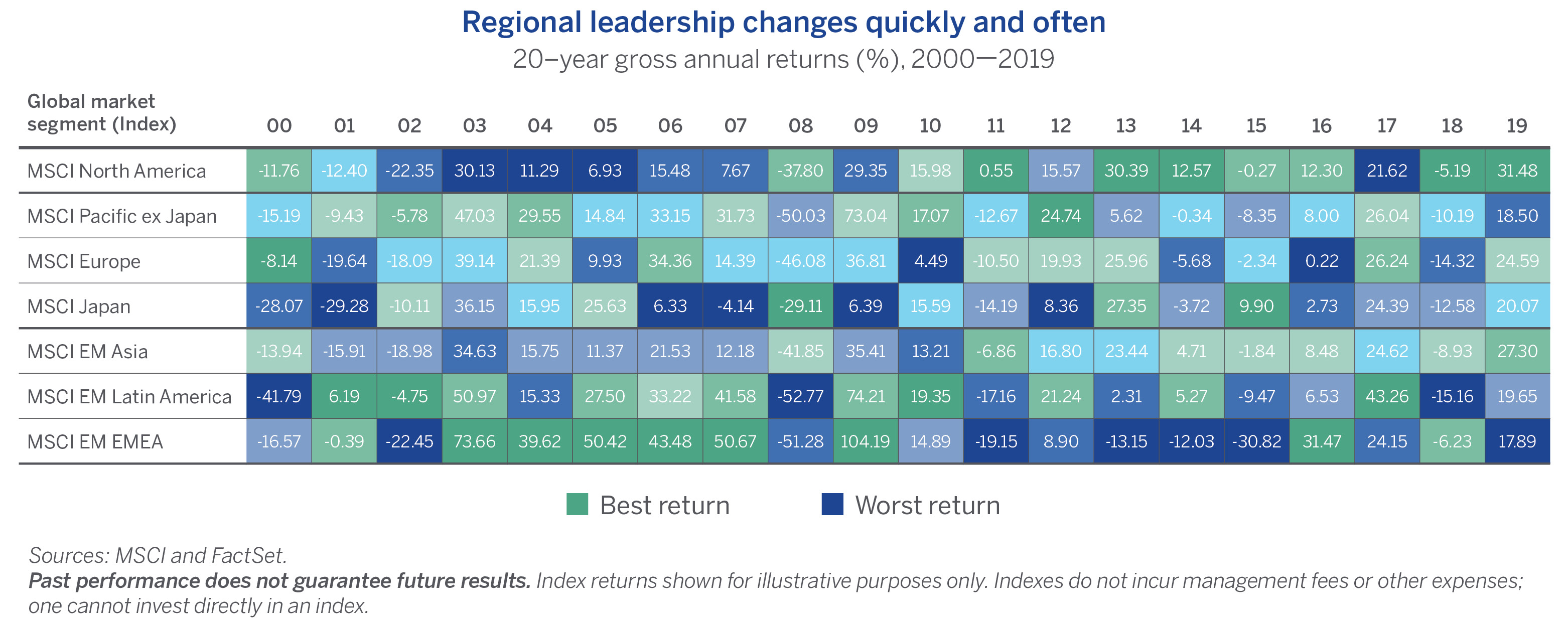

Trying to anticipate the short-term machinations of the markets is dubious at very best. That’s especially true for global equities managers where making macro or country calls is a near impossibility. The accompanying quilt chart illustrates just how mercurial regional market leadership is and just how fast it can rotate.

Even if economists are able to accurately predict GDP trends in a given country—and that’s a big if—there are political and sovereign risks to consider that may alter the relationship between GDP growth and equity returns, particularly in the shorter term.

We believe there are ample benefits to global investing, none more straightforward than the large and diverse opportunity set it offers to find potentially compelling stock stories. As a professional investor who allocates globally, we put stock selection at the forefront. By that we mean it’s more important to focus on individual businesses and the sustainability of earnings given a company’s exposures to various geographies.

In our view, stock picking—whether it comes from quantitative screens, fundamental analysis or some combination of both—should be the primary driver of portfolio alpha over time. We further believe that this emphasis is best served by an adequately diversified portfolio, which seeks to minimize unintended region and industry exposures. If our approach occasionally exhibits some modestly overweight or underweight tilts to certain regions—that’s fine. But any decision to tilt the portfolio to a certain region will never be driven by any preordained macroeconomic guess on regional or country performance. It’s never about trying to time when the U.S. is going to outperform Europe or Asia, but rather it’s a result of seeing more attractive (in our opinion) business opportunities in one region versus another.

Moreover, having a broad global mandate and being open to including both growth and value-type equities not only casts the widest net of potential opportunities, but it results in a natural hedge for investors in terms of geographic and style exposures. I would rather spend time finding attractive businesses and building a portfolio of quality companies—those that appear well positioned to create consistent shareholder value—than handicapping country growth rates or guessing when to enter a region. In that sense, timing never pays.