Who's afraid of rising rates?

SCOTT TRACY, CFA 22-Aug-2018

Interest rates are top of mind for most investors these days. Everyone seems to be parsing every word of the FOMC statement and reading between the lines for clues on monetary policy. Is the long bond bull over finally over – for real? Is a new interest rate regime here? And if so, what will be the ramifications for other assets and investment styles?

But would you be surprised if I said that I’m simply not that worried about the impact of rising rates on US equities at this juncture? Some may find that odd for a growth-focused investor. But our RS Growth Team has looked at the data and, put bluntly, we’re not afraid of rising rates.

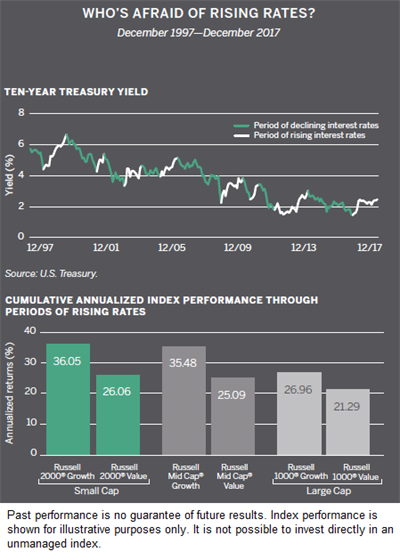

Why? We think that it’s largely a myth that growth stocks – and small cap growth in particular – will falter as interest rates rise. The data doesn’t support that conventional wisdom. It may seem counterintuitive, but growth stocks have actually performed better than their value counterparts in periods of rising interest rates over the past two decades.

Small-cap growth stocks have proved their mettle over the past 20 years, including during periods when interest rates rise. In fact, moderately rising rates tend to coincide with a strengthening economy, which should bode well for growth stocks. It should be no surprise, then, that small growth-oriented companies (as measured by the Russell 2000® Growth Index) have delivered positive cumulative annualized returns through periods of rising rates over the past 20 years.

Although the Federal Reserve has telegraphed its intent to continue raising short-term interest rates, let’s remember that rates remain relatively low in a historical context. Thus even though the Ten-year Treasury yield briefly pierced 3% this spring, significantly higher borrowing costs do not appear likely, thus do not pose a near-term threat to dynamic, small-cap growth companies. So while others may be stressing over interest rates, we are more inclined to consider what opportunities might arise should there be any near-term price volatility.