Strategic beta how-to

MANNIK DHILLON, CFA, CAIA 15-Aug-2018

Strategic beta is loosely defined as any index or related investment product that aims to provide an alternative to traditional market-cap weighting strategies of passive investments. It’s easy to see the potential appeal of strategic beta. It’s harder, however, to understand how these strategies can be used effectively integrated in an investment portfolio.

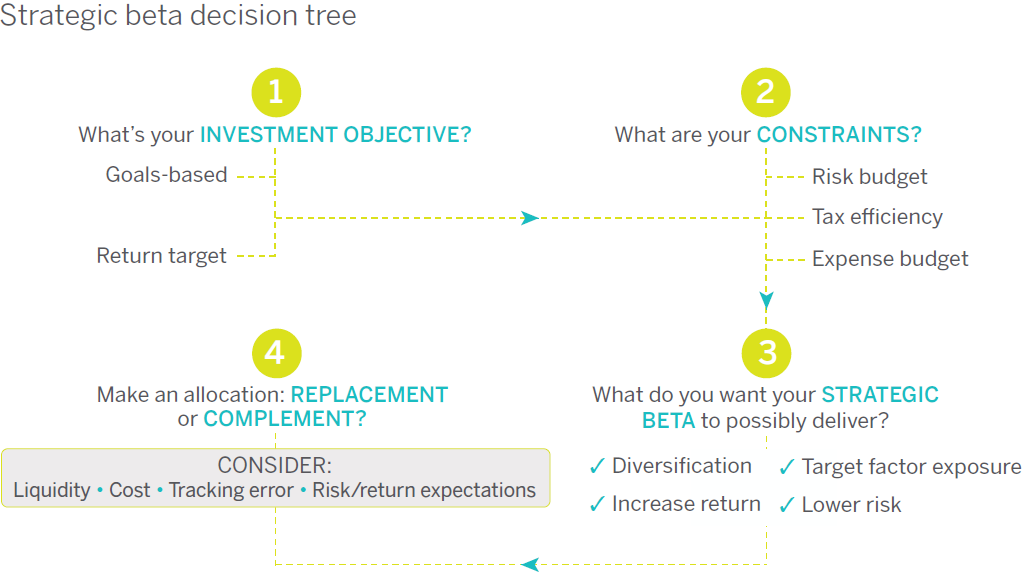

With so many flavors of strategic beta, it’s imperative for investors to work backwards and begin with an investment goal, and then embark on a search for the potentially right strategy. So the process always starts with investors and their advisors determining what each portfolio is lacking. Begin by solving for an outcome, and then select the best strategy for the job.

Since strategic beta is not an asset class, how it fits into a portfolio is a tricky question. It is not a simple formula or a percentage based on age or years to retirement as with rudimentary allocation decisions. The answer always depends on each investors’ defined objective or the inherent limitations of an existing portfolio.

That said, investors can follow a logical process to help ensure they allocate to the right type of strategies to advance on their goals. Consider the approaching retirement conundrum facing many investors. An average 50-year-old (depending on his or her current net-worth, trajectory of earnings, savings and spending) may need to achieve a return of eight percent per year to reach a given nest egg milestone, which in turn may allow for a comfortable retirement lifestyle. That would not be an uncommon scenario today, though achieving that goal appears to be getting more challenging given where we are in the cycle and lower forward return expectations for both stocks and bonds. If that investor has a simple “diversified” 60/40 portfolio of equities and fixed income, where will that investor make up the anticipated shortfall?

The challenge that this investor needs to solve for here is excess return (and possibly income in a few years), but within the context of acceptable risk and cost parameters. In other words, it’s probably not suitable to ratchet up the leverage on this portfolio as retirement approaches. And in the same manner, it might preclude an overweight position in potentially higher-returning frontier or emerging market equities, or an all-in approach on MLPs¹ or emerging market debt funds for income. In addition, investors should not forget the implications of volatility and correlation of assets² in the portfolio.

So what are the options here? Adding a few slices of various strategic beta products to the portfolio, depending on the specific approach of each fund and the investor’s risk tolerance, might be appropriate. For example, an investor could replace some passive core equities allocation with a slice of a strategic beta that combines fundamental criteria and volatility weighting in an effort to outperform traditional cap-weighted indexing. This opens the possibility to a captur-ing some alpha, acknowledging that expenses for this portfolio slice will be slightly-to-modestly higher than the high single-digits of basis points charged by some of the most efficient S&P 500® Index funds.

To balance that fee budget, investors might also consider replacing some active equities allocation with another slice of strategic beta—possibly a fund that offers investors a rules-based approach to capture potential alpha from small-cap stocks—but at a cost that may be significantly lower than typical actively managed funds.

A strategic beta product might offer a chance to potentially capture some excess returns or income by exploiting a set of factors³, for example, and doing so at a lower cost than your typical active fund. And in turn, this might even allow you to re-allocate risk or fees to niche products in other areas of the portfolio.

Ultimately, incorporating strategic beta is not a binary decision. Investors will need to look within before determining whether the potential benefits have a place in their individual portfolio. Investors should expect the typical strategic beta product to cost a bit more than the few basis points of the largest passive funds, but these products also should be more cost-effective than other active approaches that endeavor to deliver alpha. And in terms of evaluation, it’s critical to compare strategies on a risk-adjusted basis rather than on absolute performance. Relative is the key word here when contem¬plating the costs, risks, and return potential of strategic beta.